Value Chain (2012)

Furniture Industry Value Chain 2012

Value Chain Description

Note: Whereas materials used in furniture production include wood, metal, glass, plastic, and rattan, the most common material used by North Carolina furniture manufacturers is wood. Resultantly, the focus of the value chain is on wood as a raw material. However, it should be noted that under the NAIC system, furniture is classified based on the type of furniture (application for which it is designed) rather than the material used. Therefore, the statistics provided for each of the final product markets may include furniture that is not primarily constructed with wood as the base material.

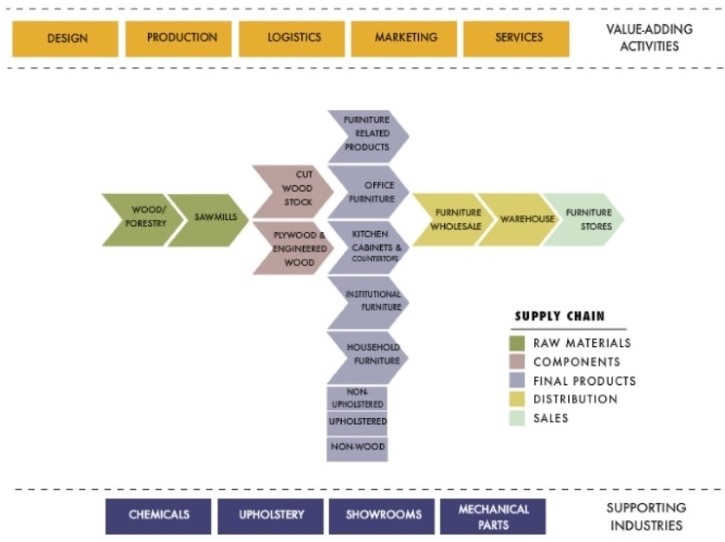

The above diagram describes the entire process of furniture production, starting with raw materials through the final marketing and distribution to consumers. Historically, yet to a lesser degree today, the largest sector within the North Carolina furniture industry value chain is household furniture manufacturing. However, due to increasing global competition, North Carolina has seen a rise in the wholesale, retail, and design portions of the value chain to remain competitive. North Carolina is still an attractive location for the furniture industry due to the presence of strong supporting industries such as upholstery and textile manufacturing and the High Point Furniture Market.1

Introduction to NCGE Value Chains

Value Chains on the North Carolina in the Global Economy (NCGE)

What is a value chain?

A value chain describes the full range of activities that firms and workers carry out to bring a product or service from its conception to its end use and beyond. This includes activities such as design, production, marketing, distribution and support to the final consumer. The activities that comprise a value chain can be contained within a single firm or divided among different firms and can be contained within a single geographical location or spread over wider areas. For additional background on the origins and research associated with this concept, see the Duke-hosted website, www.globalvaluechains.org.

Value Chain Dimensions

Each industry value chain is composed of three dimensions that work together to produce final products and services for the market. These include:

Value-Added Activities: Value is created in products and services via a series of six steps: research & development, design, production, logistics, marketing and services. Each of these varies in importance based on the industry. In the visual depictions, the top line is composed of the most important value-adding activities for each industry. When you hover the cursor over any “value-adding activities” box information on the activity and its connection to the supply chain appear.

Supply Chain: Each industry has an input-output process that begins with raw materials and continues through the making of components and final products, and finally to distribution and sales. In the value chain visuals, the supply chain is broken into five colors; each representing of the basic stages. When you place your cursor over these boxes, a description of each activity appears along with statistics (based on NAICS codes) on the number of firms, employees and average annual wages per employee in North Carolina (see the Website Overview for information on NAICS codes). The arrows represent the main stages and the boxes listed below represent specific types of products, processes or markets.

Supporting Industries: The supporting environment includes the entities that support and influence actors in the supply chain such as trade and professional associations, government agencies, testing and training facilities, community colleges and universities as well as material and machinery providers. The entities present in North Carolina are located along the bottom row of the visual. When you hover the mouse over these boxes the supply chain stages impacted by the supporting industry is highlighted and statistics or descriptive text is displayed when available.